- #How to enter expenses in quickbooks 2017 desktop how to

- #How to enter expenses in quickbooks 2017 desktop download

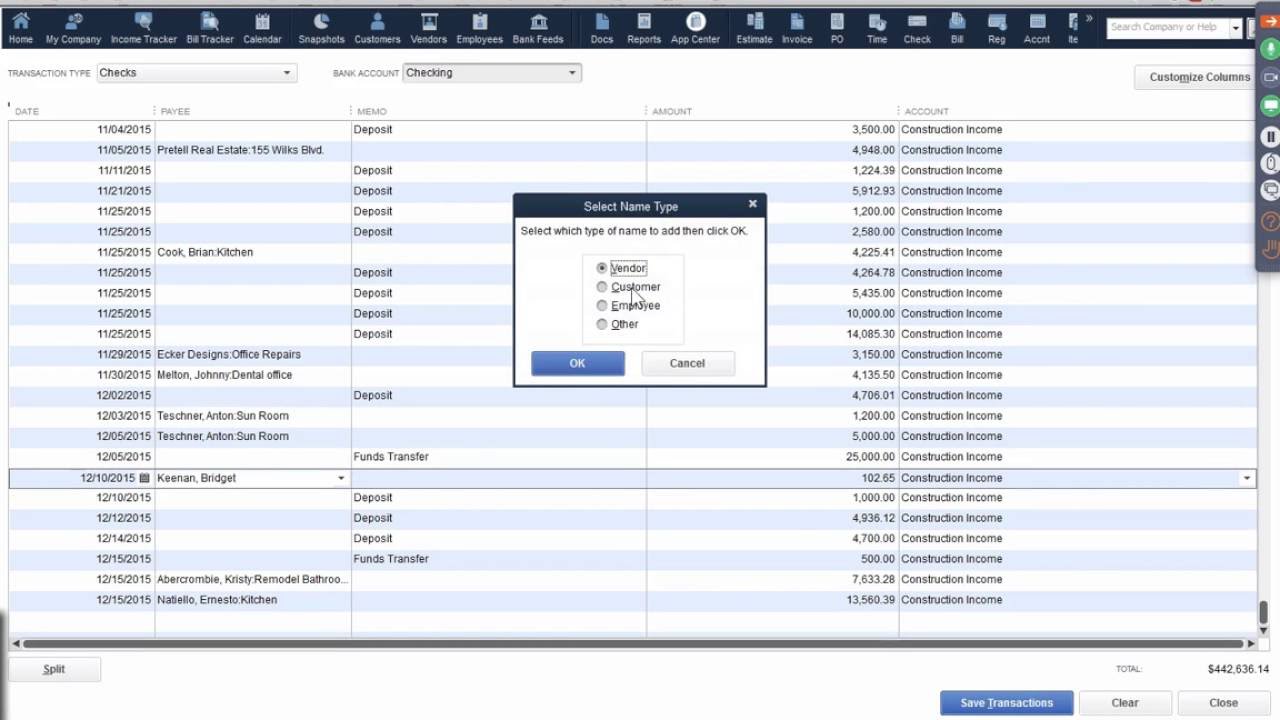

The balance in Accounts Payable might even be negative! This is wrong and produces a financial statement error: The Accounts Payable balance of the financial statement gets understated. They use the Pay Bills command without first using the Enter Bills command to describe the expense they pay the bill for. People make a common error when recording expenses in QuickBooks. But it’s less work to record one entry for one transaction, not to mention less complicated. Theoretically, Kim could enter a bill for the trinket on June 1 st, and then record a payment for it on June 1 st, and the financial statements would be accurate. The main benefit of using the Expenses tab feature in the second “Kim sells trinkets” scenario is its simplicity. In the “Jim sells widgets to Biff” example, if Biff correctly records the invoice for the widgets and subsequent payment received into QuickBooks, then QuickBooks will produce accrual-basis financial statements reporting the $1,000 of expense for June (with the actual expense occurring on June 1 st), and will produce cash-basis financial statements reporting the $1,000 of expense for July (with the actual expense occurring on July 15 th). In the “Jim sells widgets to Biff” scenario, for example, if Biff correctly records the bill for the widgets and subsequent payment made into QuickBooks, then for the period between June 1 st and July 15 th, Biff has an Accounts Payable balance of $1,000 to Jim if he prepares his June financial statements using accrual basis accounting.Īdditionally, QuickBooks also uses the information it collects through the Enter Bills and Pay Bills commands to record expense amounts under the correct date for both the accrual and cash basis financial statements the program produces. The main benefit of using Enter Bills and Pay Bills commands is that this approach enables QuickBooks to track Accounts Payable. This is an ideal situation for Kim to use QuickBooks’ Expenses tab, since payment occurs at the same moment as the sale. Kim’s trinket purchase is a business expense. On June 1 st she sells a trinket to Kim, which Kim pays for in the store with a debit card. In general, you use the Expenses tab (available on the window that QuickBooks displays when you choose the Banking menu’s Write Checks command) when the moment you incur the expense and the moment you pay the expense are the same-or in the same accounting period.Įxample: Mary owns a small retail shop. When to Use the Expense Tab of the Write Checks Window This is an ideal situation for Biff to use QuickBooks’ Enter Bills feature, since he’ll pay the bill at a later date than when he incurs the expense. Biff doesn’t pay Jim for the widgets until July 15 th. Jim completes the work and ships the widgets on June 1 st, and thus earns the revenue on June 1 st. Use the Vendor menu’s Enter Bills command when the moment you incur an expense and the moment you pay the expense are distinct.Įxample: Jim agrees to manufacture and sell Biff a crate of widgets for $1,000. Payables are expenses which a business has incurred, but has not yet paid.

Receivables are revenues which a business has earned, but has not yet collected payment on. Two types of accounts exist in accrual basis accounting, but not cash basis accounting: The key differences are summarized in the table below: In order to understand why QuickBooks has several different ways of recording expenses, you’ll need to understand a little bit about cash basis versus accrual basis accounting.

But first, we need to start with some background information on cash basis versus accrual basis accounting so this all makes sense. I’ll explain when to use the Enter Bills command versus the Expenses tab on the Write Checks window, how those features are different, and why they exist.

#How to enter expenses in quickbooks 2017 desktop how to

This short blog post explains how to record your business’ expenses in QuickBooks.

#How to enter expenses in quickbooks 2017 desktop download

0 kommentar(er)

0 kommentar(er)